Climate change could sink the value of American real estate. That's according to a recent study by First Street, which found that $1.47 trillion in home values could be wiped out over the next 30 years due to climate-related risks.

"Valued at $50 trillion, residential real estate is the bedrock of the U.S. economy—nearly double the country's $27.4 trillion GDP," the research firm, which uses advanced climate science and engineering to calculate financial risk for U.S. properties, wrote.

Climate change is eroding that same foundation by "disrupting established patterns of migration," triggering property insurance premium hikes and creating "additional financial burdens," First Street said.

Why It Matters

The increased frequency and severity of natural disasters in the U.S., which experts attribute to climate change, is already impacting the housing market—especially in vulnerable states like California, Florida, and Louisiana. In these states, which are often hit by devastating wildfires, hurricanes, storms and tropical cyclones, private insurers faced with higher costs and catastrophe exposure have either cut coverage or increased premiums to meet potentially enormous claims.

When property insurance premiums grow, properties drop in value. According to First Street, homes impacted by recent rate hikes implemented by the Federal Emergency Management Agency (FEMA) lost 54.1 percent of their value. Areas affected by extreme weather events additionally see the quality of life degrade for residents, making these parts of the country less appealing for buyers.

First Street's report is yet another study showing that climate change could profoundly change the face of the U.S. real estate market—for the worse—unless real moves are implemented soon.

What to Know

First Street expects property insurance premiums to increase by an average of 29.4 percent by 2055 due to climate change-driven weather. During those same years, 55 million Americans will relocate within the U.S. due to extreme weather events like wildfires, extreme heat, and flooding. This migration would start with the relocation of 5 million people this year, First Street said.

These same high-risk areas that have seen the highest migration levels in the country over the past decades—those promising a good quality of life and cheaper houses, like the Sun Belt region—are going to be the most affected by climate-related property devaluation, First Street said.

Texas, Florida, and California—the three largest Sun Belt states—have absorbed over 40 percent of the nation's $2.8 trillion in natural disaster costs since 1980, the company found. These three states are expected to face net declines of 10 to 40 percent by 2055, according to First Street.

"These areas have seen increases in severe weather exposure and insurance costs, resulting in a steady increase in the overall cost of homeownership," the company wrote.

Where Home Values May Decline

But the phenomenon won't be limited to the Sun Belt region. While this area is "the most dramatic example," First Street said, "insurance markets responding to the increasing awareness of climate risk are materially changing the calculus behind home ownership and the desirability of entire communities across the country."

Attractive coastal areas are now being threatened by sea level rise; affordable inland regions are facing increasingly frequent heat waves, droughts, and floods. "At the same time, the increased frequency and intensity of natural disasters has triggered unprecedented levels of property damage, prompting insurance providers to increase premiums or withdraw coverage from high-risk areas altogether," First Street said.

"Chronic climate changes create additional financial burdens—from surging utility bills to increased maintenance costs. Ultimately, environmental stressors and associated rising homeownership costs are together reshaping home values."

While the current affordability crunch in the U.S. housing market has been keeping many aspiring homebuyers off the property ladder, a majority of U.S. adults—nearly two-thirds—are homeowners. That means that a drop in home values spurred by climate change would have a direct impact on Americans and their financial health.

Where Will Home Prices Drop Because Of Climate Change?

Disaster-prone areas of the country are likely to be the most affected by property value declines, according to First Street.

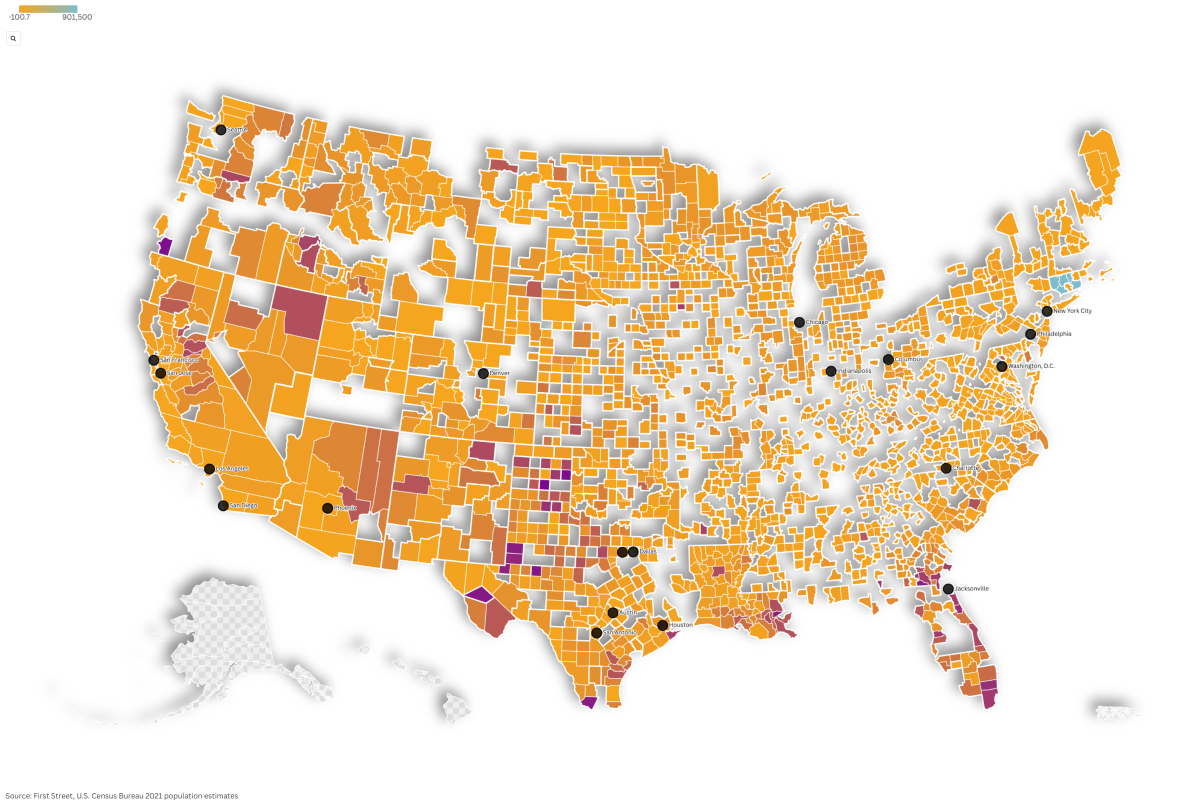

In the 21,750 high-risk neighborhoods across the U.S. classified by the research firm as facing "climate abandonment"—meaning that they're experiencing population decline and property insurance premium spikes—property values are expected to fall by 6.1 percent by 2055. That's the equivalent of some $591.9 billion.

In 22,682 high-risk neighborhoods considered at a "tipping point," where an initial population growth is being followed by a decline triggered by rising premiums, property values will fall by 3.3 percent or $543.2 billion.

In 25,594 high-risk neighborhoods facing "risky growth"—where population growth continues despite escalating insurance premiums—property values will drop by 1.7 percent or $335.5 billion.

These high-risk areas are clustered along the Sun Belt, particularly in Texas and Florida, with additional concentrations along the East Coast, West Coast, and Midwest.

In climate-resilient areas—concentrated in the Midwest and part of the Eastern U.S.—property values are expected to increase by 10.8 percent or $244 billion in the next three decades. First Street identified a total of 4,107 low-risk neighborhoods which are attracting newcomers while keeping stable insurance rates as "climate resilient."

What People Are Saying

Jeremy Porter, First Street's head of climate implications research, told CBS News: "Climate change is no longer a theoretical concern; it is a measurable force reshaping real estate markets and regional economies across the United States. Our findings highlight the urgent need to understand how rising insurance costs and population movements are transforming the economic geography of the nation."

What's Next

There are reasons to be cautious about First Street's projection, Abrahm Lustgarten, an environmental reporter for ProPublica, wrote in a recent guest essay for The New York Times. The research firm's economic models don't take into account the "immense equity" accumulated by American homeowners over the past two decades, and making predictions on migration patterns is something of a gamble.

However, the study shows what could happen in the U.S. real estate sector if climate change actually drives similar changes in homeownership and migration as those expected by First Street.

fairness meter

About the writer

Giulia Carbonaro is a Newsweek Reporter based in London, U.K. Her focus is on U.S. and European politics, global affairs ... Read more